Some Known Facts About Estate Planning Attorney.

Wiki Article

Our Estate Planning Attorney Statements

Table of ContentsUnknown Facts About Estate Planning AttorneyNot known Details About Estate Planning Attorney The Buzz on Estate Planning AttorneyThe Facts About Estate Planning Attorney RevealedThe 6-Second Trick For Estate Planning Attorney

A seasoned attorney that understands all elements of estate planning can aid ensure customers' desires are performed according to their objectives. With the appropriate guidance from a reliable estate coordinator, people can feel certain that their plan has been developed with due treatment and attention to information. Individuals need to spend ample time in finding the best attorney that can supply sound advice throughout the whole process of establishing an estate plan.The papers and guidelines developed during the preparation procedure come to be legitimately binding upon the client's death. A competent economic advisor, according to the wishes of the departed, will then begin to distribute trust properties according to the customer's guidelines. It is important to note that for an estate plan to be effective, it must be correctly carried out after the customer's fatality.

The assigned administrator or trustee have to guarantee that all possessions are managed according to lawful demands and in accordance with the deceased's desires. This usually includes collecting all documentation pertaining to accounts, financial investments, tax obligation documents, and various other products specified by the estate plan. On top of that, the administrator or trustee might require to collaborate with lenders and beneficiaries associated with the circulation of assets and other issues relating to clearing up the estate.

In such scenarios, it may be necessary for a court to interfere and settle any kind of disputes before final distributions are made from an estate. Inevitably, all facets of an estate should be worked out efficiently and properly in accordance with existing laws to make sure that all celebrations included receive their reasonable share as meant by their loved one's desires.

6 Simple Techniques For Estate Planning Attorney

Individuals require to clearly recognize all aspects of their estate strategy prior to it is set in activity (Estate Planning Attorney). Dealing with a seasoned estate planning lawyer can aid guarantee the records are correctly composed, and all assumptions are met. On top of that, a lawyer can provide understanding right into how different lawful tools can be used to shield assets and make best use of the transfer of wealth from one generation to one more

Estate preparing refers to the preparation of jobs that take care of a person's financial situation in the occasion of their incapacitation or death - Estate Planning Attorney. This preparation includes the bequest of assets to successors and the negotiation of estate tax obligations and financial obligations, along with various other factors to consider like the guardianship of small kids and pets

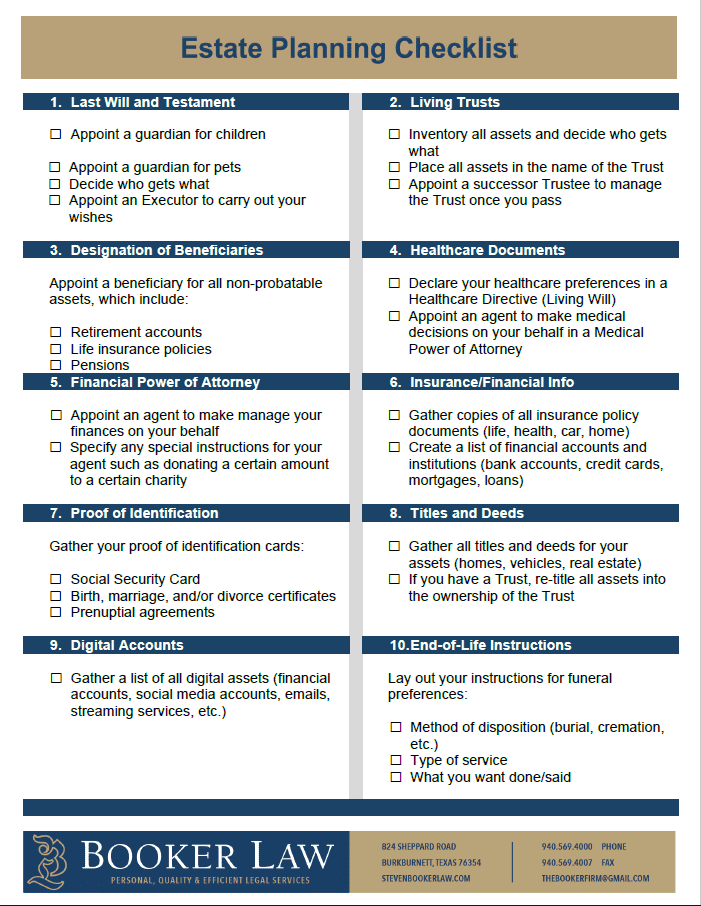

Some of the actions include noting properties and financial obligations, examining accounts, and writing a will certainly. Estate intending tasks include making a will, establishing depends on, making philanthropic donations to limit inheritance tax, naming an executor and recipients, and establishing funeral arrangements. A will certainly offers guidelines regarding residential property and custodianship of minor youngsters.

The Ultimate Guide To Estate Planning Attorney

Estate preparation can and ought to be made use of by everyonenot simply the ultra-wealthy., managed, and distributed after death., pensions, financial obligation, and extra.

Any individual canand shouldconsider estate planning. Writing a will is one of the most crucial steps.

Keep in mind, any type of accounts with a beneficiary pass straight to them. Make certain your recipient info is up-to-date and all of your other details is exact. Set up joint accounts or transfer of death designations.

i thought about this

3 Easy Facts About Estate Planning Attorney Explained

8. Write your will. Wills do not simply unravel any type of economic uncertainty, they can additionally lay out prepare for your minor kids and family pets, and you can also instruct your estate to make philanthropic donations with the funds you leave this page behind. 9. Evaluation your records. See to it you examine whatever every pair of years and make changes whenever you see fit.

Send out a copy of your will certainly to your manager. Send out one to the individual that will certainly presume obligation for your affairs after you die and keep an additional copy somewhere safe.

Estate Planning Attorney for Dummies

There are tax-advantaged investment lorries you can benefit from to assist you and others, such as 529 university cost savings prepares for your grandchildren. A will certainly is a lawful paper that supplies guidelines regarding how a person's building and wardship of minor children (if any kind of) ought to be handled after fatality.:max_bytes(150000):strip_icc()/estate_planning_shutterstock_525382207-5bfc307846e0fb00517cd38d.jpg)

Report this wiki page